LIFE INSURANCE: WHY YOU NEED A TERM PLAN

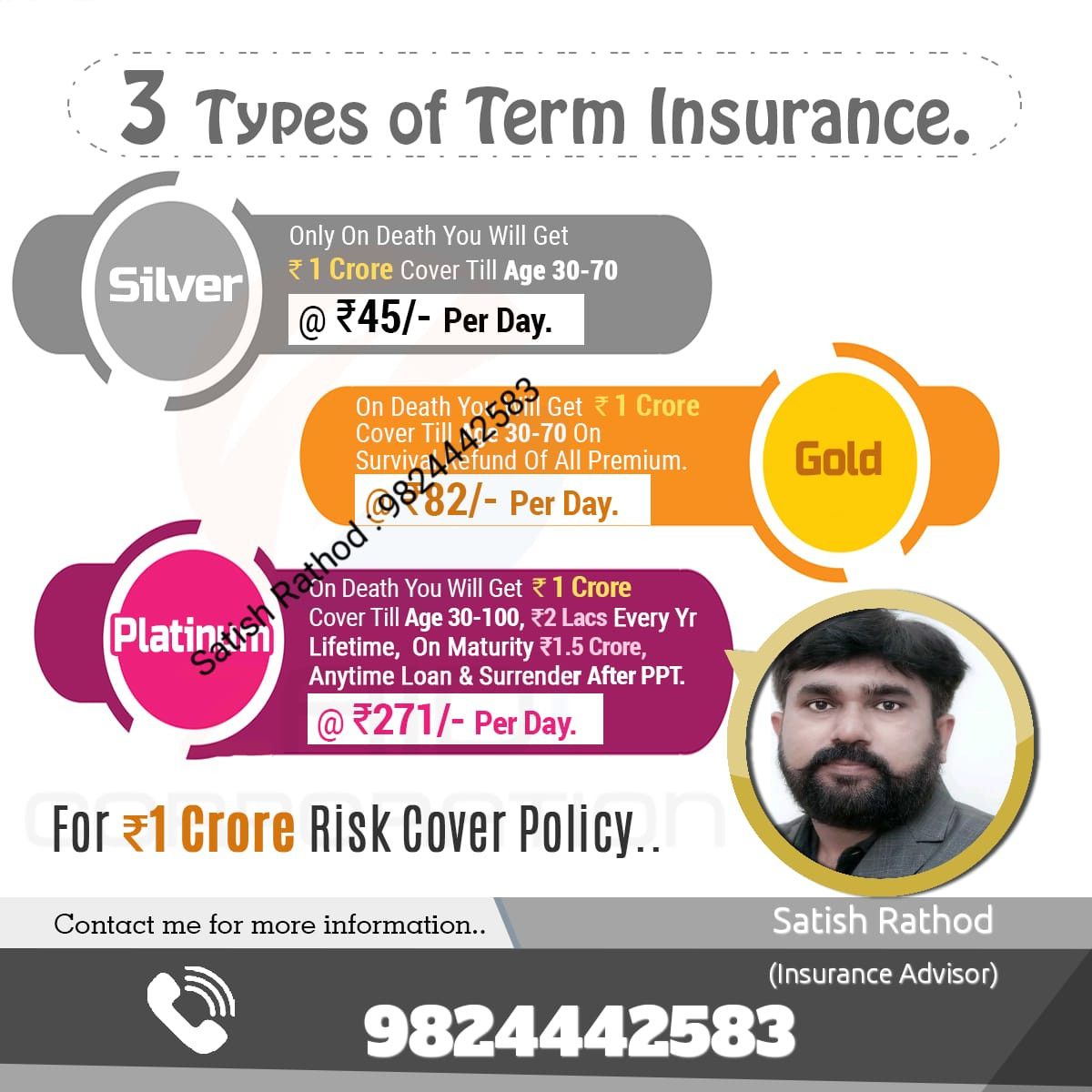

While there are several types of life insurance policies, one should buy a term insurance,

which is the cheapest form of life insurance and helps in ensuring financial protection for

the family. In a term plan, the insurer does not make any payment if the insured survives

the policy period. However, many insurers have a term plan with ‘return of premium’ where

the insurer returns the premium paid or a guaranteed amount if the policyholder survives

the policy term.

Ensure that the total sum assured of all life policies put together adequately covers your

dependents in the long run. Ideally, the sum assured should be at least 10 times of the

policyholders’ annual income. The sum assured will be the amount that the insurance

company will pay to the policyholder in the case of an unpredictable event. Experts say,

before buying a life insurance policy, especially a term plan, do a proper assessment of

the liabilities and future expenses and go for the sum assured which can help the family

to meet expenses and repay debts in case of your premature death.

Renew policy on time

Always pay the renewal premium by the due date. Insurers give a grace period which is 15

days after the due date in case the premium is paid monthly and 30 days in case the

premium is paid on a quarterly, half-yearly or yearly. A policy is still in force during the

grace period and if anything happens to the policyholder during that period, the nominee

is eligible for the claims. However, if the premium is not paid even during the grace period,

the policy lapses and all benefits covered under it are terminated.

Riders with life insurance

Riders are additional benefits taken along with the basic cover and are much more

affordable than buying a separate insurance policy. A term plan with a critical illness rider

pays a lump sum amount of money to the policyholder on being diagnosed with major

illnesses like cancer, stroke, heart attack or multiple organ failure. The premium on the

critical illness riders cannot exceed 100% of the premium under the basic product and

premiums under all other life insurance riders in total cannot be over 30% of premium paid

under the basic policy.

An accidental death benefit rider pays the nominee the death sum assured in addition to

the basic sum assured of the policy, in case of death of the policyholder. In a permanent

disability rider, if the insured is permanently disabled due to an accident, the insurer will

pay a percentage of the benefits accrued due to the rider every month for a specified

number of years. All further premiums on the base cover are also waived off.